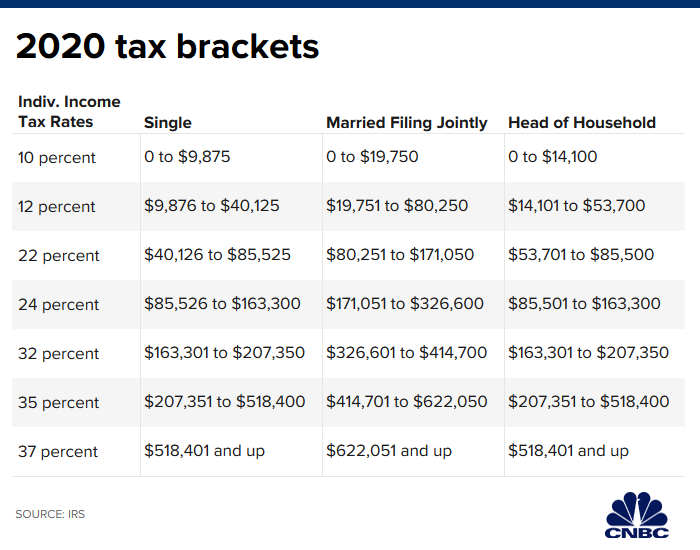

Contact us to discuss further.Ģ021 Taxable Income Rates on Long Term Capital Gains Rate It also helps generate better after-tax returns. Tax efficient investing is important to not only reduce your current tax liabilities, but to manage your future tax liabilities as well. Is my investment strategy and the investments in my taxable account appropriate?.Does it make sense to invest in a tax-exempt bonds and money market fund for my savings?.What interest rates are taxable bonds and money markets paying compared to tax-exempt bonds and money markets?.With this knowledge, a few questions arise: The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for long-term capital gains) is either 0, 15. In this scenario, if you earned an additional $5,000 in interest and dividends, your additional tax liability would be approximately $1,462.50 ($5,000 * 29.25%) leaving you really with $3,537.50. That means that any additional income would be taxed at 29.25%.Īdditional taxable income may come from interest from bank accounts and/or dividends and capital gains from taxable investments. As a “married filing jointly” couple in North Carolina, you would be in the 24% tax bracket at the federal level and 5.25% at the state level, for a combined tax rate of 29.25%. The 2020 standard deduction amounts are 12,400 for single, 18,650 for head of household or 24,800 for married filing joint. For example, if your spouse and you earn $250,000 from your jobs and have $40,000 of various deductions, your taxable income would be $210,000. It is important to know your marginal tax bracket to understand the tax consequences of additional income. Locate your taxable income in the appropriate tax filing (single, joint, etc.) to estimate which marginal tax bracket you are in. Each dollar over 178,150 or 21,850 would fall into the 24. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.The 2021 tax rate schedules below are provided to help you determine your marginal tax bracket at the federal and state level. Say a married couple, filing jointly for the 2022 tax year, had a taxable income of 200,000. There are no guarantees that working with an adviser will yield positive returns.

Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). All investing involves risk, including loss of principal. This is not an offer to buy or sell any security or interest.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Here are the brackets and rates for the past several years including the current rates for 2023 (applying to 2022 returns).

Income tax brackets 2020 head of household code#

28, 2023 The tax code changes every year, bringing new brackets, rates, and rules for filers. Securities and Exchange Commission as an investment adviser. Personal Finance 2023 income tax brackets (marginal tax rates) Written by David Weliver Modified date: Apr. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S.

0 kommentar(er)

0 kommentar(er)